Bitcoin Bounces from $33,000 as Rothschild Investment Add to Their Bitcoin Holdings

- Marcus Sotiriou

- Jan 25, 2022

- 2 min read

Updated: Feb 18, 2022

GB Market Commentary 25/01/2022

by Marcus Sotiriou

Bitcoin finally showed strength yesterday as it bounced from a weekly demand area in the low $30,000 region. The US stock market capitulated, with the Nasdaq down more than 4% at the low of the day, before mounting an incredible comeback to finish the day green.

It appears that market participants have been protecting themselves ahead of tomorrow’s FOMC meeting, where Jerome Powell will give more clarity on monetary policy, as well as being cautious due to uncertainty with warfare between Russia and Ukraine. Risk assets should see a meaningful bounce when protective positions unwind, which could occur after tomorrow’s FOMC meeting if Jerome Powell confirms that the first rate-hike will be in March. However, equities and crypto may experience further downside if the Federal Reserve choose to hike rates sooner than March.

Whilst sentiment has been extremely bearish within the crypto market, Bitcoin’s strength relative to the stock market was telling yesterday, with noticeable bidding on Coinbase. Could this be a sign of institutions re-entering the market? I think likely, as these large corrections typically result in the transfer of wealth from ‘weak hands’ (short-term holders) to ‘strong hands’ (long- term holders). Data presented by on-chain analyst Willy Woo further suggests that institutional money may be coming back into the market, as coins are shown to be moving back to whale holders.

Rothschild Investment is an example of a major financial institution who has bought during this downturn, as they bought another 93,521 shares of Grayscale Bitcoin Trust (a fund making it easier for traditional investors to gain exposure to Bitcoin) totalling their holdings to 232,311 shares.

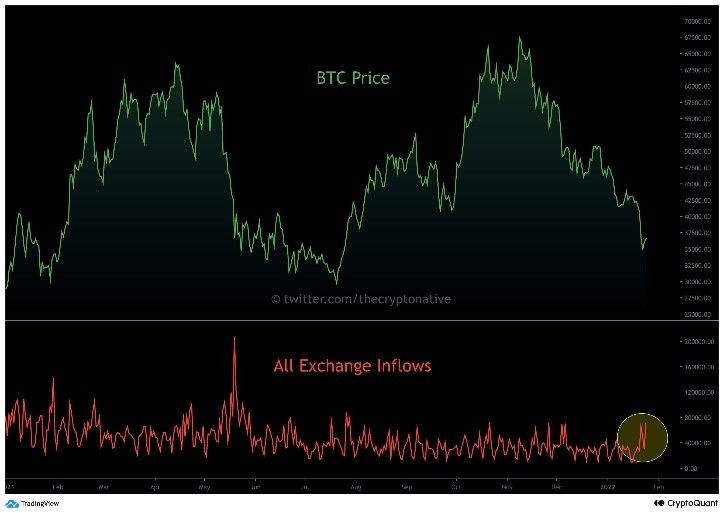

However, we cannot be confident that the bottom is in, as data from CryptoQuant shows exchange inflows spiking over the past few days. This could be in anticipation of tomorrow’s FOMC meeting, as people may be getting ready to sell in case Jerome Powell’s stance is more hawkish than expected.

Comments